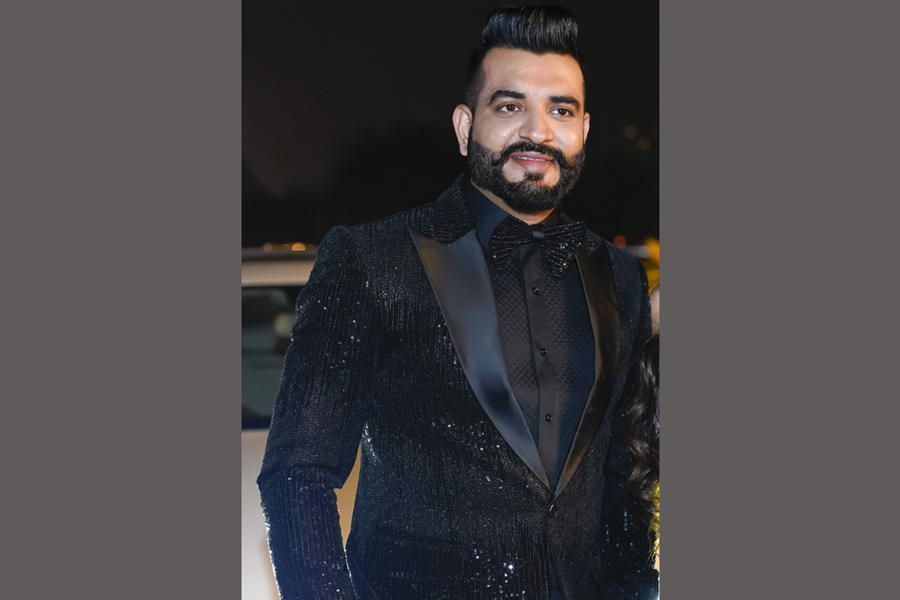

Impact of Omicron on Real Estate Market – Sachin Arora

Real estate body CREDAI affirmed that there won’t be a major impact of the new omicron variant on India’s holding market, construction continues as planned while new project launches won’t be hampered.

CREDAI isn’t expecting any disruption in project construction pace and deliveries too shall go as committed unless there’s a major rise in infections within the months to come, it said in a statement.

After the two consecutive waves of the pandemic and Developers are totally ready to manage any disruption relating to supply chain and labour supply to an oversized extent. If nothing rupture the routine then homebuyers will get possession on time. whereas the price of flats are expected to examine a five-ten per cent rise, at the end-user level, primarily to off-set the same or “more than that” hike in stuff cost; bookings of existing properties or launch of recent ones are unlikely to see a direct adverse effect.

“The future impact of omicron is nonetheless to be ascertained. But, as of now, we have a tendency to don’t foresee a lag in bookings or new property launches due to the variant. Micro-market fluctuations may see a better (than 5-10 per cent) worth rise for buyers.” said Sachin Arora, Director at Investors Clinic Infratech Private Limited.

Despite the sturdy second wave of the Covid pandemic, property sales were seemingly to extend over the 2020 level this year.

The important estate developer community is hesitatingly positive however cautious at constant time. Within the past eight months, since the Coronavirus-induced internment was lifted, the real estate trade has witnessed a gradual recovery. The second wave of COVID-19 affected the trade a bit as a result of when the primary internment stage in Gregorian calendar month 2020, folks completed the worth of home ownership. there’ll not be any forceful come by land prices.

The first purpose of Non-Resident Indians (NRIs) to take a position in real estate has been rental returns. However, the uncertainties oil-fired by the pandemic across the planet have driven the NRI community to possess a place in India as well. With deposit rates falling within the range of 6-7 percent, and therefore the reduced value of the rupee against the America Dollar, the NRIs are actively searching for investment opportunities in the Indian land market.

“The pandemic has fostered the utilization of virtual visits, and this has enabled the NRI community to browse, choose and invest in real estate online.” Sachin stated.

After all, this isn’t a new challenge to the Realty industry. Be it the lag of 2008 or the notorious Non-Banking Finance firms (NBFCs) crisis, the real estate sector has controlled the challenges head-on. Although the recovery is certain, the second wave has delayed the process. Moreover, with the anticipation of the third-wave within the offing, there could be some impediments and challenges for the sector to deal with. However, loads depend on the dispatch of the vaccination drive and therefore the measures taken by the govt to spice up the important estate revival.

whereas rental yields have remained intact, the fall in rate of interest on deposits is creating them additional attractive. The distinction between rental yields (3 percent) and interest rates (7 per cent) has become terribly narrow. Even with a marginal appreciation of 3-4 per cent, property seems attractive. Moreover, tax write-offs on consumer credit interest and principal bring down the price of a loan below five per cent for folks in higher-income tax brackets.

Be it in the high time of real estate investment, Arora said, “While end-users shouldn’t attempt to time the important estate market, property costs are at their lowest best, Investments for currently equals buying at rock bottom doable price.”