Pre Union Budget Recommendations – Healthcare

Increase in budgetary allocation for healthcare

India’s share of public and private healthcare spending was estimated to be 3.6 per cent of GDP including both the public healthcare spending and out-of-pocket expenses which is quite low as compared to various developed countries including the US, the UK, Japan, Germany, and Canada whose spending is nearly 10–18 per cent of their GDP on healthcare. While India’s population has grown nearly 15per cent over the last decade, this growth has not been complimented by an equitable growth in healthcare spending.

It is time that healthcare is provided the requisite focus in India to help build a stronger public health system, along with appropriate support to the existing private healthcare infrastructure to create a comprehensive healthcare ecosystem.

As per Union Budget 2021–22, the total public health sector allocation stood at 1.2 per cent of the GDP and it is expected to increase to 2.5 per cent of GDP by 2024–25. However, there is a need to increase the public health spending to 2.5–3.5 per cent at the earliest.

Further there is a need to incorporate alternative financing models to address the financial gaps in health sector and ensure mandatory health coverage for all to support the Universal Health Coverage (UHC) targets.

I. GST rationalisation for Hospitals

Correcting the prevailing inverted duty structure

Since GST is not payable on health care services, health care service providers are not eligible to avail credit on the input taxes paid by it, which ultimately becomes a cost for the service provider. Under current GST regime, the net impact of revised tax rates on inputs (goods and services) consumed by hospitals has increased.

With this background, we would like to represent before you two options which will help ease the costs of healthcare for the consumer, and align with the objective of ensuring affordable healthcare to all.

Option 1 – Zero rating and subsequently allowing output GST levy at 5% to the health care sector

Zero rating of GST for Hospitals can bring maximum relief at a time like this. It is respectfully requested that the Government should consider zero rating of healthcare services for a period of 24 months during this pandemic period, which will not only ensure that the input tax credit chain is intact but also ensure that the input taxes are not loaded into the cost of healthcare services. Currently, GST paid on inputs, input services and capital goods used for healthcare services are not eligible for input tax credit since the output service is exempt. Zero-rating would not break the chain of duty / tax flows in the structure. This will also ensure immediate relief to the healthcare sector to navigate the current pandemic.

While we would respectfully request the Government to continue giving this benefit to the sector for a longer period of time, in the event that the Government believes that zero-rating benefit is not sustainable, it is respectfully requested that the Government may consider the option to treat the health care services as taxable supply of services at a lower rate of 5% after the period of 24 months. This would go a long way in keeping healthcare services costs affordable, without breaking the input tax credit chain.

Option 2 – Providing end-user-based exemption to major services consumed by the healthcare sector

If the Government decides to persist with the GST exemption status provided for the healthcare services without Zero rating it, we respectfully table the following recommendations, for immediate implementation:

Grant end-user-based exemptions to input, input services and capital goods for healthcare sector. Such exemption could include (not limited to):

a) Leasing of medical infrastructure including leasing of building / premises to hospitals for providing health care services to be exempted.

b) Providing exemptions to suppliers of various auxiliary services in relation to health care such as

- – Housekeeping services

- – Food and beverages supplies and catering services

- – Annual Maintenance contracts paid for Equipment maintenance and upkeep

- – Transportation

- – Outsourcing contracts for labour / staff etc

c) Rationalize the rates of tax for all medicines and consumables to a rate of 5% maximum so as to retain the tax chain for other suppliers/ industries.

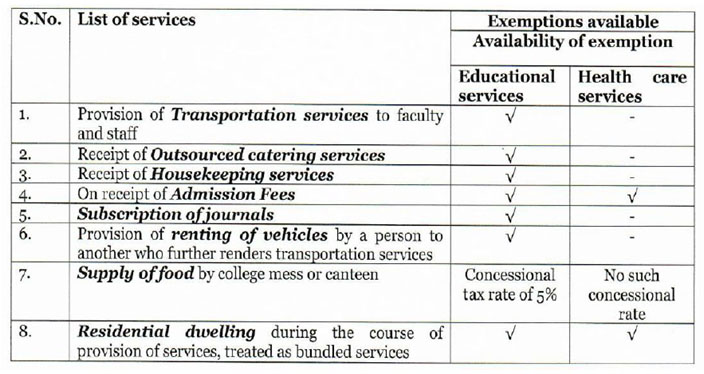

Similar exemptions are already provided to other sectors like the educational sector :

GST Others

(a): GST Exemption for supplies between head office and branch office:

Under the GST Law, supplies between head office and branch office in two different states will be subjected to levy of GST even in the absence of any consideration. Since health care service is an exempted service, GST paid by the branches/ head office on such inter – unit transfer will also accumulate as ineligible credit.

Health care service providers will be benefitted if exemption is provided for any inter – office supply between head office and branch office for healthcare service providers. Therefore, it is humbly prayed for that inter – state supply of goods or services between distinct persons be exempted from levy of GST for the health care service providers.

(b): GST at rationalised rates for Medical capital goods:

Healthcare service in today’s world, requires highly sophisticated and advanced technology. Even the medical furniture has to be of a minimum standard to ensure provision of best service to the patient. Such medical equipments, machines and furniture are broadly covered under the 18% GST rate slab. Considering that such items extremely expensive, it is represented to reduce the rate of GST, to minimise the impact of GST cost to the industry.

II. Hospital Lease rentals to be GST exempt to foster creation of large REIT structures for Hospital Infrastructure

The honourable Prime minister and the current government has correctly recognised and acknowledged the fact that healthcare is going to be fundamental to India’s economy growth. A robust health ecosystem will play a key role in for the future and to be instrumental in building a $5 Trillion GDP economy.

Global sovereign funds as well as other long term investors from across the world are keen to fund creation of infrastructure and while Indian companies could be operators these funds look at long term yields from such investments. The current GST regime on lease rentals is a dampener as the 18% GST is an additional cost to the Operators / Healthcare Providers, that cannot be set off. It will be a welcome measure if the Government can hence exempt say hospitals with over 100 beds / 100,000 sft from GST on lease rentals under an Operating Co. / Property Co, model, which will unlock infrastructure capital for the sector.

This will help the sector evaluate options like Hospital REITs to build much larger capacities across India without prohibitive capital exposure, and create incremental healthcare infrastructure, which are currently unviable due to the 18% GST leakage.

III. Introduction of Mandatory Health Insurance to ensure Universal Healthcare Access

An important pillar of healthcare service delivery is Access. World over, insurance models have been found to be very effective mechanisms for improving access to quality care. Currently, only around 4% of the population in India have health insurance coverage. This has led to a situation where out of pocket healthcare spending constitutes 86% of total healthcare spends in India. Further, a vast majority of the rural poor are unable to access quality healthcare. The major reason for the low penetration of health insurance is because it is currently optional.

It is requested that the Government could also explore making health insurance coverage mandatory for all citizens.

A stratified or phased approach could be considered as follows:

- Employees in the organised sector should be mandated to be covered by the employer (with the premium being recovered from salary, partly or fully) under an attractive group insurance scheme which can be a part of the employee benefits provided by the employer. This mandate should include cover for employees, who are currently covered under ESI.

o As ESI employees will be covered by insurance, the Government may consider subsuming the ESI hospitals across the country for deployment on the Ayushman Bharat scheme, which will substantially increase the infrastructure and beds available under the Scheme

▪ Mandatory Health Insurance for self-employed professionals – Professionals such as Lawyers, Doctors, Chartered Accountants, Architects etc, should be mandated to obtain health insurance cover for themselves and their dependents, and disclose the same in their Income Tax Returns.

▪ Affordable Insurance Policy for Elders (aged 55 and above) to cover specific health risks arising from vulnerabilities of old age such as Parkinson’s, Falls, Alzheimer’s, Incontinence, Vertigo, Osteoporosis (among women) etc.

▪ Increase in quantum of deduction towards payment of medical insurance premium u/s 80D: In order to provide an incentive for health insurance, and encourage voluntary purchase, the present annual deduction limit of Rs. 25,000/ u/s 80D should be enhanced to Rs. 50,000/ for self and family, and the current annual limit of Rs. 30,000/ in respect of dependent parents enhanced to Rs. 50,000/. The Government may also consider expanding the ambit of dependents eligible for this deduction.

These steps will create the change in behaviour among healthcare consumers, and will create sufficient risk pooling for insurers which can help in eventually making Mandatory Health Insurance a reality.

IV. Incentivizing health-oriented consumer behaviour

Medical reimbursement exemption limit for salaried employees to be set at Rs 50,000/ p.a.

Till the time of the changes made in the 2019’s Union Budget, there was an annual Medical reimbursement limit set at a sum of Rs 15,000/ per annum under Section 17(2) of the Income Tax Act which was fixed in April 1999. This has been merged along with conveyance allowance into a composite standard deduction limit of Rs 40,000. Given the significant rise in cost inflation index in general (70% over the last 5 years) and medical inflation in particular, the medical reimbursement deduction needs to be re-introduced and the annual limit needs to be enhanced to not less than Rs 50,000/.

Introduction of a separate deduction in respect of preventive health checks

Given the rising advent of lifestyle diseases in India and the need to prevent loss of productivity, it is imperative that employers get a separate annual deduction of upto Rs 10,000/- per employee, towards expenses incurred for sponsoring the health check expenses of their employees. This should be over and above the proposed limit of Rs 100,000 per annum in respect of medical reimbursement for salaried employees.

Also, individuals should be allowed a separate deduction of Rs 10,000 per person annually in respect of Preventive Health Checks undertaken by themselves, and their families. Currently, the deduction is limited to Rs 5000 for all persons, and is included in the overall deduction available u/s 80 D (medical insurance premium)

V. Healthcare to be declared National priority and infrastructure creation to be incentivised through a comprehensive set of tax and other capital benefits

Over the last 4 decades, the private sector has emerged as a pivotal supplier of healthcare services. It is estimated that over 80% of new bed additions in the last 10 years was contributed by the private sector. This sector is the fifth largest employer in the country and has the potential to generate millions of direct and indirect jobs. To truly position India as a global destination for healthcare, and to bring the best of healthcare to our own citizens, the private sector needs to be an active partner.

For this, it is important that the Government puts in place forward-looking policy frameworks and incentives to help the sector not only remain viable, but to bring further investment into the sector (including FDI), expand reach and bed density, invest in technology, foster a culture of innovation and retain the best clinical talent in India. The regulatory framework under which the sector operates needs to incorporate this thinking and drive the narrative accordingly.

It is critical that the healthcare sector be declared as a National Priority and incentives announced for the creation of capacity and infrastructure with a comprehensive set of measures such as:

- Provision of land free of cost or at highly subsidized rates to set up facilities;

- Higher FSI for hospital buildings, as they are required to be located in central areas;

- Rates for power to be reduced to about 50% of applicable commercial rates;

- Formulate modalities for declaring “Special Healthcare Zones” in key geographies with attendant benefits such as earning exemptions for facilities located there, infrastructure support, manufacturing incentives, etc;

- Incentives for accelerated job creation and training of skilled workforce;

- Extended tax holidays to enable ploughing back of earnings into infrastructure investment.

- Provision of incentives for new health care projects

- New Projects:

- To spur investment in the sector, the Government could consider tax holiday period of 15 years for hospitals with a minimum of 100 beds. The length of period of exemption needs to be long, as new hospitals take at-least 5-7 years to start earning returns, after recovering interest and depreciation.

- Also capital subsidy at 25-30% of total project cost may be provided in all Non-metro locations to spur infrastructure creation outside of Tier I locations

- ▪ Interest Subsidy at ~5%, for atleast 5 years would help in making hospitals turn financially viable in an accelerated way.

- Consider import duty relief for lifesaving equipment, not manufactured in India – There is a need to revisit the classification to make the import duty on life saving equipment consistently low or even exempt to ensure lower cost of healthcare services delivery. Also, it needs to be ensured that GST input credit is allowed to be set off against such customs duty, to lower the landed cost.

VI . Ease of Doing business and enabling viable operations for hospitals

For private investment in infrastructure to grow, the ease of doing business within the sector needs to be optimal. To that end, there are a few measures that will go a long way to enhancing ease of doing business for the private sector:

Strict Credit Term of not more than 60 days for CGHS, ECHS, Ayushman Bharat and other Central Government Schemes, as well as credit treatments availed by Central PSUs:

Private healthcare providers have been trusted partners of the Government in providing healthcare of the highest quality to employees of the Central Government and Ex-Servicemen under the Central Government Health Scheme and Ex-Servicemen Contributory Health Scheme (ECHS), even though sometimes, the package / procedure rates offered under these scheme have not even covered the marginal cost of treatment. However, it has been a difficult experience that reimbursements for completed treatments under these schemes are not made on time, and in most cases, remain unpaid even for 2-3 years (in some cases even upto 6 years), causing severe stress on working capital and cash flows for private healthcare providers. The interest cost incurred on holding these receivables (running into hundreds of crores for the sector), is a significant sum, and puts pressure on the profitability and viability of several units. The digital backbone that is supporting paperless claims under the Ayushman Bharat Scheme and is facilitating majority of the payments under the scheme being made under 30 days, may also be adopted for patients treated under CGHS and ECHS.

Re-visit of Package Rates under CGHS, ECHS, Ayushman Bharat:

In a scenario of limited supply of skilled manpower (clinical and support), and limited physical infrastructure, it is not the case that a high increase in demand from a low-paying segment of the population will create opportunities for private healthcare which will exponentially increase profitability. In fact, the ramp-up in beds, equipment, doctors and other skilled manpower that such an increase in demand will entail, will require significant investments, which may not be recoverable through the package rates that are offered under the various central and state schemes. We believe that the rates of reimbursement under the CGHS, ECHS and Ayushman Bharat schemes, are not viable. We do not believe that the rates reflect the true cost of quality healthcare. We request for revision of rates, and introduction of tiered rates for different sizes, accreditations, and specialty-coverage of hospitals. Tertiary and Quaternary Care hospitals, performing complex work across specialities, with strong national and international accreditations, should be eligible for higher reimbursement rates.

VII. Incentivize Medical Value Travel for the healthcare sector to contribute to India’s foreign exchange reserves

Medical Tourism is expected to more than double in size to reach a size of USD 10.6 bn from USD 4 bn in 2015. To further aid the growth of this segment, we recommend the following measures:

(1) Policy support to encourage and facilitate medical value travel to India, and develop medical value travel as an organised sector.

(2) Launch a “Heal in India” campaign, on the lines of the very successful “Make in India” campaign.

(3) Facilitation by Indian Embassies abroad: Our Indian embassies and missions abroad can run dedicated Medical Value Travel desks, acting as a single stop for comprehensive information relating to partners, procedures, costs and visas. The embassies could also facilitate road shows and events in partnership with private healthcare players abroad and promote India as a major destination for Medical Value Travel.

(4) Welcome desks at all Indian Airports: Establishing a single-stop facilitation counter at all key Indian airports handling International Traffic will go a long way in supporting travellers at the first point of their arrival in India.

(5) Insurance recognition for Indian providers: Getting international insurance companies to recognise the clinical programs run by Indian healthcare providers, who have achieved the highest standards of quality and patient safety, will encourage international patients to visit India. The Government of India should facilitate such recognition by International Insurers, by placing this point as an agenda for discussion in Bilateral Discussions on Economy, Trade and Commerce with other countries.

(6) Income from the services provided by Healthcare service provider to foreign nationals in India who come for Medical Treatment (in India) should be treated as export of services and deduction should be given not only under Chapter VI A but also ensure that foreign currency income earned is fully exempt from taxes. The said move will boost Medical tourism in India thereby increasing foreign currency reserves for the country.

VIII. Others

Increase in period available for claiming EPCG credit by three years

Under current rules, any importer under an EPCG license has to meet the export obligations equivalent to 6 times of the import duty saved under EPCG within 6 years.

However, during 2020 & 2021 (and possibly till March 2022), International travel has been severely affected by Covid-19 restrictions on travel. The healthcare industry was hugely affected as India was one of the largest healthcare services exporters at affordable prices.

Due to this huge loss of international revenue, export obligations could not be met in the last 2 years. All importers in the health care industry are bound to face huge liabilities on this account. Also, it is not possible to cover such a huge loss incurred in 2 years in any one 1 year or so.

It is earnestly requested that the window of 6 years provided for fulfilment of foreign exchange earnings obligations under the Export Promotion of Capital Goods scheme ( which stipulates that an importer of medical equipment should fulfil foreign exchange earning obligations which is equivalent to 6 times of the import duty component saved while importing medical equipment) should be relaxed for a further period of three years for the healthcare sector since restrictions on international travel imposed since the onset of the COVID-19 pandemic since March 2020 has severely impacted medical value travel flows to India and led to a significant decline in foreign exchange earnings.

Ms Suneeta Reddy

Managing Director,

Apollo Hospitals Group.